Thailand tourism revenue is projected to return to normal by 2024, according to new research by McKinsey and Co. A quicker recovery could be hampered by ‘virus recurrence, slow long-term growth and muted world recovery ‘it says.

The ‘Reimagining travel: Thailand tourism after the Covid-19 pandemic ‘report expects international travellers to generate about $68 billion by 2024.

It suggests lesser-known destinations like Chiang Rai and Loei should be developed to attract the mass-affluent segment.

Thai tourism revenue may recover to pre-pandemic levels by 2024, though attracting “quality” travellers from new source markets is essential for a pronounced rebound, according to new research by McKinsey and Company.

“Projections are always challenging from the evolving nature of the pandemic, however, international visits and spending in Thailand could recover by 2024, assuming some virus recurrence, slow long-term growth, muted world recovery, and minimal changes to global tourism strategies,” said Steve Saxon, partner at McKinsey & Company’s Shenzhen office and leader of the firm’s travel practice in Asia.

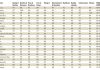

International travellers are predicted to generate US$68 billion by 2024, compared to $62 billion in 2019, if Thailand can maintain a low infection rate, according to the latest report “Reimagining travel: Thailand tourism after the Covid-19 pandemic”.

Overall tourism receipts from both international and domestic markets are forecast at $111 billion in 2024 from $96 billion in 2019.

Mr Saxon said Thai tourism can develop new tourism sources to compensate for the lack of Chinese visitors by focusing on markets where travel demand recovers more rapidly.

The US, the UK, Germany and Japan are among the top countries after Thailand’s reopening on Nov 1. Meanwhile, India is also considered a potential market for Thailand.

The industry has to promote different travel offerings such as ecotourism and cultural tourism as well as expanding to new lesser-known destinations like Chiang Rai, Ratchaburi and Loei to attract the mass-affluent segment, especially younger tourists who prioritise travel experiences.

He said operators have to balance quality and quantity of tourists as supply in the country still needs to be fulfilled, while the domestic market remains vital to sustain the industry.

In addition, operators have to stay agile in order to keep up with rapid changes in Covid-related measures in each country.

After the country’s reopening, the key lesson learned is that all sectors can jointly work together to support tourism recovery by forming partnerships across the ecosystem, said Pipavin Sodprasert, partner at McKinsey & Company’s Bangkok office.

Apart from the government’s stimulus and guidelines on health and safety policies, medium-term support for small and medium-sized enterprises on digitalisation, such as online travel services and digital marketing in the form of a one-stop tourism platform can maximise benefits for the sector.

She said data collected from 30 million users of “We Travel Together”, a hotel subsidy scheme, has to be effectively analysed to offer personalised tourism products that meet locals’ demand and allow stakeholders to connect with the information through an integrated digital ecosystem.